Trained to Track

Top 10 Reasons to Study EconomicsWhen Albert Einstein died, he met 3 New Zealanders in the queue outside the Pearly Gates. To pass the time, he asked what were their IQs. - adapted from The Economist 13 June 1992

Kenneth Boulding said, "Mathematics brought rigour to Economics. Unfortunately, it also brought mortis." Definition: Policy Analyst is someone unethical enough to be a lawyer, impractical enough to be a theologian, and pedantic enough to be an economist. Practice economy at any cost. Three econometricians went out hunting, and came across a large deer. The first econometrician fired, but missed, by a metre to the left. The second econometrician fired, but also missed, by a metre to the right. The third econometrician didn't fire, but shouted in triumph, "We got it! We got it!" An economist was standing at the shore of a large lake, surf-casting. It was the middle of winter, and the lake was completely frozen over, but this didn't seem to bother the economist, who stood there patiently casting his lure out across the ice, slowly reeling it in again, then repeating the process. A mathematical economist came sailing by on an ice boat, and pulled to the shore beside the surf-fishing economist to scoff. "You'll never catch any fish that way," said the mathematical economist. "Jump on my ice-boat and we'll go trawling." Source: netec.wustl.edu

Bookkeeping Gimmicks Proliferate, Cheating InvestorsAs if investors didn't have enough to worry about with the stock market flatlining these days, news last week showed that the financial numbers they need to make informed decisions too often can't be relied on. On Tuesday, securities regulators hit accounting giant Arthur Andersen with a $7 million fine over charges that it allowed an audit client to overstate its income by $1.4 billion. On the same day, Merrill Lynch reported that tech companies used accounting gimmicks to inflate earnings. And on Wednesday, Morgan Stanley charged telecom firm Qwest used accounting tricks to do the same after a merger deal. (Qwest and Arthur Andersen don't admit to wrongdoing.) Last week was, unfortunately, just a sampling of the widespread accounting abuses that cost investors confidence in the market, not to mention money. Some of the practices are perfectly legal, and regulators and private auditors have done little to stop them. In fact, as USA Today reported last week, problems appear to be proliferating. Companies restated more financial statements in the past three years - 464 - than in the previous seven. In one case, software firm BroadVision had been boosting its earnings by understating expenses. When BroadVision finally revealed this in April, shareholders who trusted its numbers lost $415 million. Had investors known what was missing, they might have dumped the stock earlier. Other shoddy accounting involves companies publicising in press releases their rosy "pro forma" earnings, which omit some expenses while hiding the uglier news in less noticed filings to the SEC Merrill Lynch says pro-forma earnings at 23 top high-tech companies, including former high-flier JDS Uniphase, exceeded reported earnings by 38%. One common trick is to hide the potential cost of stock options used to compensate workers. High-tech companies fail to cut revenues by the amount they'd lose if employees cashed the options. According to Merrill Lynch, accounting for the stock options would have sliced by an average 60% the 2000 earnings of a selection of firms ranging from America Online to Texas Instruments. These problems aren't new. Three years ago, former SEC Chairman Arthur Levitt blasted companies for massaging their books, by among other things counting revenue prematurely and understating expenditures. But companies resist reform. The Financial Accounting Standards Board, for example, tried to make US companies subtract options expenditures from revenue in the early 1990s. High-tech firms, among others, successfully pressured FASB to water down the rule, effectively leaving the loophole in. Neither the SEC nor Congress has sought to close it, either. Companies say the rules need flexibility to address a wide variety of business practices, and that in many cases fixing problems such as options reporting would make financial statements look worse than they need to. What they miss is the need for investors to have numbers they call count on. Besides, honest accounting doesn't hurt quality companies for long. In the early '90s accounting-rule changes required firms to subtract future retiree-health costs. Even though the change cost some companies tens of billions of dollars, they subsequently roared in the market. In the stock market, honesty really is the best policy - for investors and firms alike. Earnings DropSome companies make their balance sheets look better by obscuring costs, especially stock options for employees. Here's how much several companies' 2000 earnings decline when such charges are subtracted from income:

Source: USA Today 25 June 2001 from Merrill Lynch

Stock Options Must Be ExpensedCount one for the bean countersby Matt Krantz After years of heated debate between high-tech companies and accountants, the head accounting rule-setting body Thursday declared all companies must subtract the cost of stock options from their earnings starting in mid-2005. It's a massive blow for companies, mainly in Silicon Valley, which had been doling out lucrative stock options to employees and executives for decades but not counting them as a cost. It also requires investors to rethink how they value companies: The new rule will affect everything from price-earnings ratios to earnings estimates. Accountants, thinking companies had been enjoying a loophole that understated their costs, applauded the decision. The new rule will have "a big impact, but it's the right move," says Ed Nusbaum, CEO of accounting firm Grant Thornton. The rule change, approved by the Financial Accounting Standards Board, represents a massive shift because it:

High-tech firms are not pleased. "We remain opposed to expensing and will continue to work with the Congress, the administration and the SEC to come to an accurate, auditable, transparent solution," says Cisco Systems' spokesman John Earnhardt. Senator Peter Fitzgerald, Republican - Illinois, one of the rule's champions, says he fears companies will wait for his retirement this year and try to derail the rule before it kicks in 15 June. Silicon Valley companies "will stop at nothing to stop this (rule) from going into effect," he says. Source: usatoday.com 16 December 2004 See also:

Do You Want to Be a Forensic Accountant?by Julie Adams Spectacular financial ripoffs have featured in the news in recent years, and close on the heels of white-collar criminals are forensic accountants - a new breed of number crunchers who scrutinise documents and identify discrepancies which can lead to prosecution. How do they differ from run-of-the-mill accountants? There are 27,500 registered accountants in New Zealand and forensic accountancy is one specialised field of the profession. The term "forensic" means "used in a court of law." What do they do?If a business or organisation suspects an employee of fraud, then a number of bloodhounds are called in to sniff cash trails. Generally, forensic accountants are called in to uncover evidence of major fraud - cases larger than those normally dealt with by police. A crucial part of the job is presenting evidence to management staff and on behalf of the prosecution during a trial. What qualifications do you need?You will need a bachelor of commerce or business studies degree. You must be a member of the Institute of Chartered Accountants (which requires passing specified university papers and further examinations). Experience in fields like auditing, tax and merchant banking is invaluable, as is a good understanding of criminal law. Enforcement experience, for example with the police, is also useful in in-depth investigations. New graduates wanting to specialise in this field from the start are encouraged to think carefully about planning their career and to send their resumes to employers like the Serious Fraud Office (SFO). Where would I work?Some accountancy firms have spotted the trend in combatting occupational fraud and set themselves up to specialise in forensic accountancy. The SFO remains the leading fraud investigation unit in the country, but currently has only eight positions. Personal attributes?A systematic nature is a must-have. In the recent case of Lower Hutt solicitors Ross Partners, investigators sifted through 50,000 documents to secure the evidence needed for prosecution. Top quality presentation skills are also needed. If the case goes to court you will have to present what is often very complex evidence to the jury in a clear manner and undergo cross-examination by the prosecution. There is no room for cutting corners and fuzzy logic. How much can I earn?The SFO would not reveal what it pays its forensic accountants. However, as a broad indication, graduates entering a corporate graduate scheme would expect to start on between $29 - $35 thousand. Within 3 - 4 years of becoming fully qualified, they should be earning about $55,000, with top performers and specialists earning substantially more. In a recent survey, accountants with 5 - 10 years of financial analysis experience earned, on average, $93,000. Best and worst aspects?SFO forensic accountant Ann Pomfret says being able to complete a job thoroughly is one of the most satisfying aspects. "You have to be very sure of what you are doing. It's more real than just number crunching." The worst thing, she said, was undergoing cross-examination. "Giving evidence is not something you look forward to. It's nerve-wracking." Contact Julie Adams, phone 011 644 474 0507 Source: The Evening Post Tuesday 25 August 1998 See also:

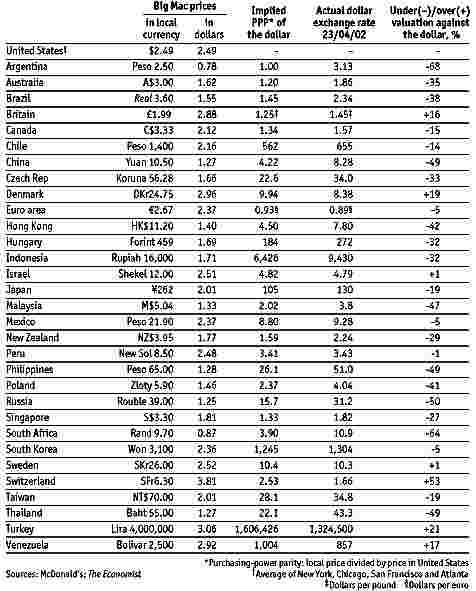

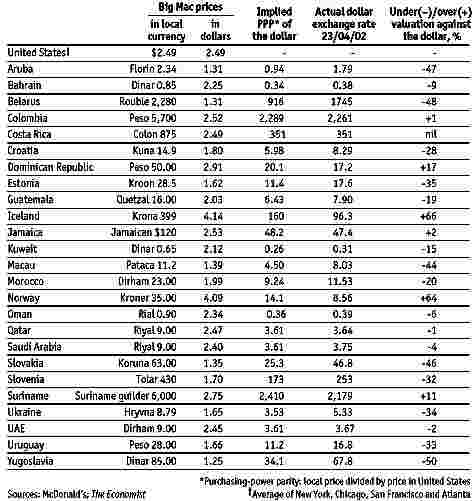

Was This Prophetic Or What?Big Mac Currencies - 2002In the history of the Big Mac index, the dollar has never been more overvalued Currency forecasters have had it hard in recent years. Most expected the euro to rise after its launch in 1999, yet it fell. When America went into recession last year, the dollar was tipped to decline; it rose. So to help forecasters really get their teeth into exchange rates, The Economist has updated its Big Mac index. Devised 16 years ago as a light-hearted guide to whether currencies are at their "correct" level, the index is based on the theory of purchasing-power parity (PPP). In the long run, countries' exchange rates should move towards rates that would equalise the prices of an identical basket of goods and services. Our basket is a McDonald's Big Mac, produced in 120 countries. The Big Mac PPP is the exchange rate that would leave hamburgers costing the same in America as elsewhere. Comparing these with actual rates signals if a currency is under- or overvalued. The first column of the table shows the local-currency prices of a Big Mac. The second converts these into dollars. The average American price has fallen slightly over the past year, to $2.49. The cheapest Big Mac is in Argentina (78¢), after its massive devaluation; the most expensive ($3.81) is in Switzerland. By this measure, the Argentine peso is the most undervalued currency and the Swiss franc the most overvalued. The third column calculates Big Mac PPPs. Dividing the Japanese price by the American price, for instance, gives a dollar PPP of ¥105, against an actual exchange rate of ¥130. This implies that the yen is 19% undervalued. The euro is only 5% undervalued relative to its Big Mac PPP, far less than many economists claim. The euro area may have a single currency, but the price of a Big Mac varies widely, from euro2.15 in Greece to euro 2.95 in France. However, that range has narrowed from a year ago. And prices vary just as much within America, which is why we use the average price in four cities.

The Australian dollar is the most undervalued rich-world currency, 35% below McParity. No wonder the Australian economy was so strong last year! Sterling, by contrast, is one of the few currencies that is overvalued against the dollar, by 16%; it is 21% too strong against the euro. Overall, the dollar now looks more overvalued against the average of the other big currencies than at any time in the life of the Big Mac index. Most emerging-market currencies also look cheap against the dollar. Over half the emerging-market currencies are more than 30% undervalued. That implies that any currency close to McParity (for example, the Argentine peso last year, or the Mexican peso today) will be overvalued against other emerging-market rivals.

Adjustment back towards PPP does not always come through a shift in exchange rates. It can also come about partly through price changes. In 1995 the yen was 100% overvalued. It has since fallen by 35%; but the price of a Japanese burger has also dropped by one-third. Every time we update our Big Mac index, readers complain that burgernomics does not cut the mustard. The Big Mac is an imperfect basket. Hamburgers cannot be traded across borders; prices may be distorted by taxes, different profit margins or differences in the cost of non-tradable goods and services, such as rents. Yet it seems to pay to follow burgernomics. In 1999, for instance, the Big Mac index suggested that the euro was already overvalued at its launch, when nearly every economist predicted it would rise. Several studies confirm that, over the long run, purchasing-power parity - including the Big Mac PPP - is a fairly good guide to exchange-rate movements. Still, currencies can deviate from PPP for long periods. In the early 1990s the Big Mac index repeatedly signalled that the dollar was undervalued, yet it continued to slide for several years until it flipped around. Our latest figures suggest that, sooner or later, the mighty dollar will tumble: relish for fans of burgernomics. Source: economist.com 25 Apr 2002 from The Economist print edition See also:

According to this article, the currencies which are undervalued by 1/3 or more (and probably a good investment to buy?) are Argentina, Aruba, Australia, Belarus, Brazil, China, Czech Republic, Estonia, Hong Kong, Macau, Malaysia, Philippines, Poland, Russia, Slovakia, South Africa, Thailand, Ukraine, Uruguay and Yugoslavia. The currencies which are overvalued by 1/3 or more (and probably a smart move to sell?) are Iceland, Norway and Switzerland. Does the US currency belong in either of these two categories? You'll have to make up your own mind about that...

For articles related to working including why, which career, bosses, time constraints, focus, trends, gender issues, pay differentials, getting laid off, getting re-hired, dependents, part-time work

and balancing work and values click the "Up" button below to take you to the Index page for this section on Working. |

Animals

Animals Animation

Animation Art of Playing Cards

Art of Playing Cards Drugs

Drugs Education

Education Environment

Environment Flying

Flying History

History Humour

Humour Immigration

Immigration Info/Tech

Info/Tech Intellectual/Entertaining

Intellectual/Entertaining Lifestyles

Lifestyles Men

Men Money/Politics/Law

Money/Politics/Law New Jersey

New Jersey Odds and Oddities

Odds and Oddities Older & Under

Older & Under Photography

Photography Prisons

Prisons Relationships

Relationships Science

Science Social/Cultural

Social/Cultural Terrorism

Terrorism Wellington

Wellington Working

Working Zero Return Investment

Zero Return Investment Talk is cheap. Supply exceeds Demand.

Talk is cheap. Supply exceeds Demand.