The High-Tech Hills?

It's Time for An Economic Boost, Not An Economic BootMaybe in order to understand mankind we have to look at that word itself. MANKIND. - Weird Wellington Happenings and Links Yesterday's Reserve Bank announcement to increase the Official Cash Rate to 8.0% will worry all homeowners with mortgages and businesses requiring credit. New Zealand has the highest interest rates in the developed world and it surely affects our economic prospects. In contrast, the official rate in Australia is 6.25%. New Zealand's interest rates have been higher than Australian rates virtually all my life. The usual reasons put forward for New Zealand's high interest rates are the small size of our economy, the high levels of total indebtedness, the volatility of the economy and the narrow export base. The Governor of the Reserve Bank has one mission; to keep down inflation. Low inflation provides certainty in the economy and ensures that inefficiencies are transparent. Inflation has increased in recent times as a result of buoyant consumer demand, a tight labour market, international fuel prices and a buoyant property market. The Governor has added a further reason; the high level of government expenditure. Experience tells us that increased interest rates will also drive our currency up, as international investors purchase more New Zealand bonds. So far, the increase in the currency has not affected exports too seriously. Global demand and increased export prices have mitigated the impact for many exporters, but at some point a rapidly appreciating currency will cause real harm. New Zealand's attachment to our sovereign currency clearly has real costs. We have much higher interest rates than our neighbour, Australia. We have greater currency volatility. We also incur significant currency transaction costs, and the added cost of running the Reserve Bank. It is not surprising that John Key raised the question of whether New Zealand should, in essence, adopt the Australian currency at the Australia-New Zealand Leadership Forum in May. If New Zealand took this step we could expect seats on the Board of the Reserve Bank of Australia, which could be renamed the Reserve Bank of Australia and New Zealand. We should be able to have our own distinct notes and coins, as is the case with the distinctive Royal Bank of Scotland notes for the British currency. Naturally, they would need to be the same size as the Australian currency in order to be interchangeable. Some will lament the loss of our unique currency, and will argue that we will be tied to a currency in an economy that follows different cycles to the New Zealand currency. In fact, the two economies are quite closely in sync, and the two currencies normally rise and fall together, even if the New Zealand currency is a little more volatile than Australia's. Imagine interest rates being 2% lower than at present, and in fact 2% lower than New Zealand interest rates at any stage over the last two decades. That would be a permanent boost to our economy. It may even help arrest New Zealand's continuing brain drain to Australia, which is now at 700 people per week. The loss of sovereignty exists simply in our imagination. Are the French any less French by adopting the Euro? It's time to have a serious discussion on the future of our currency. Source: scoop.co.nz 8 June 2007 Column: New Zealand National Party The Mapp Report waynemapp.co.nz

This is a very complex issue requiring a lor of thought. I'm not so sure I agree with the writer. I wonder why he doesn't seem to want to even entertain the idea of NZ becoming an Australian state. I'm not sure I'd like that either, but it doesn't seem to me to be all that removed from sharing currency.

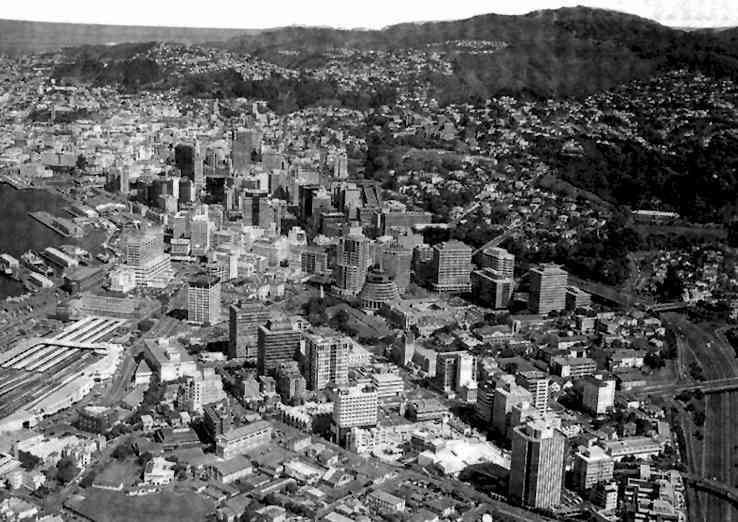

Note the Changes the Years Have Brought:

Wellington, New Zealand's capital city. Looking down at the Railway network and Station, busiest in New Zealand.

The Sky's the Limit - Wellington's reputation as a progressive exciting city has resulted in a number

of new and existing businesses,

Workforce in the Global Creative Economyby Richard Florida In March of 2003, I met Peter Jackson, Academy award-winning director of the Lord of the Rings trilogy, in his hometown of Wellington, New Zealand. Jackson did something unlikely in Wellington, a city of roughly 400,000: He built one of the most advanced filmmaking complexes in the world — a “global talent magnet,” he called it. There, he could attract the best cinematographers, sound technicians, computer graphics artists, model builders, and editors from around the globe. As we walked past a wall map with pins showing the studio workers’ native countries, the head of digital animation joked that the organisation looked more like the UN than a film studio. Jackson told me his key lure was to offer exciting, challenging work with a secure future in a city with abundant natural beauty, affordable housing, and an outstanding quality of life for people of nearly every income bracket. Jackson's accomplishment in tiny Wellington hasn't factored into any of the recent debates over business competitiveness, jobs or economic growth — but it should. American economic experts and policy-makers are rightly preoccupied with the emergence of behemoths like India and China, which offer huge markets, capable workforces, and cost advantages. Unfortunately, they overlook a subtler but even more profound shift in the nature of global competition. In the past 2½ decades, this shift has taken us from the older industrial model to a new economic paradigm, where knowledge, innovation, and creativity are key. At the cutting edge of this shift is the creative sector of the economy: science and technology, art and design, culture and entertainment, and the knowledge-based professions. The US is at the forefront of this global creative economy. Over the next decade, it’s projected to add 10 million more creative sector jobs, according to the newest numbers from the Bureau of Labor Statistics. At the present rate of increase, creative jobs alone will soon eclipse the total number of jobs in all of manufacturing. Already, more than 40 million Americans work in the creative sector, which has grown by 20 million jobs since the 1980s. It accounts for more than US$2 trillion — or nearly half — of all wages and salaries paid in the US. Such remarkable job growth goes far beyond technology and engineering. While the US economy will add 950,000 computer jobs and another 195,000 in engineering, the biggest gains by far will be in health care and education, which will add more than 3.5 million. Jobs for college professors alone are projected to increase by more than half a million. Arts, music, culture, and entertainment will contribute some 400,000 new jobs. That’s twice as many as engineering. The rise of this global creative economy changes the rules of international competition in 4 crucial ways.

So while it’s crucial to spur investment in science and engineering, and to lessen the growing gaps in the international technology talent base, business and government leaders must also recognise that the leading sources of job growth in the creative economy come from sectors outside of high-tech. To continue down the current path will mean far greater regional concentrations of wealth, mounting economic inequality, growing class divides, and eventually worsening political tension and unrest within countries and on a global scale. It’s time to wake up to the new realities of the creative economy, and stop developing policy for a bygone industrial age. Our only path forward is to make the creative economy work for us — by undertaking regional, national, and global efforts to harness the creativity of each and every human being, aligning the further development of human creative capabilities with the further growth and development of our economies. They did it in Wellington; the challenge of our time is how to do it not just in one region or even one country, but on a truly global scale. Richard Florida is the Hirst Professor in the School of Public Policy at George Mason University, and the author of The Flight of the Creative Class (with a new edition in paperback from HarperCollins, Fall 2006) and The Rise of the Creative Class (Basic Books, 2002). Visit www.creativeclass.org for more information. Source: cato-unbound.org 4 June 2006

For satellite photos and pictures of Wellington from several different angles and for articles about earthquakes, history, business, the Ohariu Valley, statistics, fireworks, the

national anthem, the kiwi icon and more click the "Up" button below to take you to the Index for this Wellington section. |

Animals

Animals Animation

Animation Art of Playing Cards

Art of Playing Cards Drugs

Drugs Education

Education Environment

Environment Flying

Flying History

History Humour

Humour Immigration

Immigration Info/Tech

Info/Tech Intellectual/Entertaining

Intellectual/Entertaining Lifestyles

Lifestyles Men

Men Money/Politics/Law

Money/Politics/Law New Jersey

New Jersey Odds and Oddities

Odds and Oddities Older & Under

Older & Under Photography

Photography Prisons

Prisons Relationships

Relationships Science

Science Social/Cultural

Social/Cultural Terrorism

Terrorism Wellington

Wellington Working

Working Zero Return Investment

Zero Return Investment