They Don't Pay Taxes Anyway

Thought ExerciseOnly those who attempt the absurd...will achieve the impossible. - Escher He who joyfully marches to music in rank and file has already earned my contempt. - Albert Einstein ...One of my flatmates is even somewhat worth arguing with, on occasion. He hasn't thought most of his socio-political ideas through well enough though. Focuses far too much on "fairness", I think. Silly notion. Of course the world isn't fair. And a good thing. He reckons that if you abolished inheritence, it would abolish war, once people got used to it. Even if you COULD do it, it'd be truly awful. A static society is a DEAD society. Also a peaceful one. And definetly a fair one. You'd abolish a huge part of the incentive for progress. I'm attempting to write an essay arguing that far from abolishing inheritance, you should completely exempt the top 100 richest people from all taxes... also from most minor laws: traffic violations, that sort of thing. But, if you kill them, you get all their money, and don't get prosecuted (special class of citizen, you see). Perhaps they should also form the Senate in the US political system. I reckon it would be GREAT fun, really vitalize society (ambition, vertical mobility, and inequality are GOOD things...for progress), and you could sell the TV rights for enough money to fund the welfare system for a decade. :-) Essentially, I think political systems worked a LOT better when, if worst came to worst, you could always get a new leader the EASY way. Assasinating presidents doesn't have any point, since they don't let the assassin be president. The scary thing is, I thought it up as a semi joke, but the more I think about, the better it sounds. For a start, most of the current billionaires would become VERRRRY altruistic. A lot of people wouldn't want to be on the list. In particular, anybody that thinks they can make MORE money in the future will be sure to give away as much money as it takes to drop them off the list. And since the bar to be on the list keeps dropping as people do that, there'd be a decent-sized VOLUNTARY wealth redistribution effect - possibly to the extent that there'd be no more billionaires quite quickly. Now, people that are unable to make more money (that is, parasites, really) would want to KEEP their money, even if it put them on the list - where, of course, they likely wouldn't last particularly long. <shrug> I thought it was an amusing idea, anyhow... Source: personal email from my son, Cody.

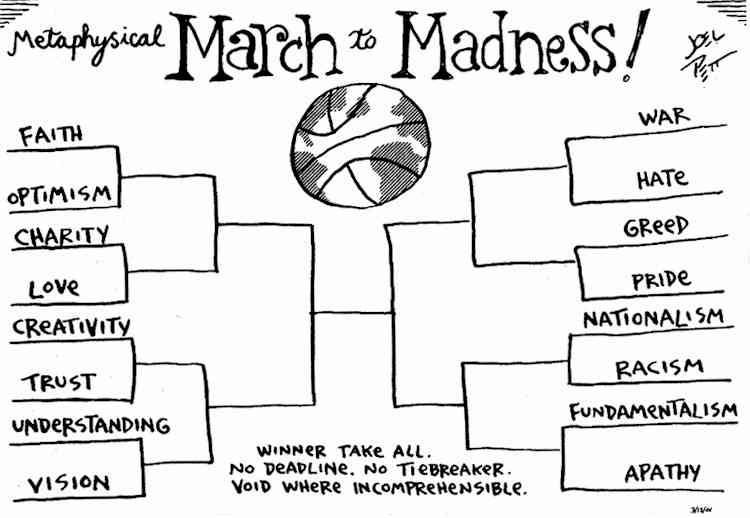

Winner Take All

Source: Funny Times June 2001

Thought MarathonSecrets and the Prize

Well-informed winners: Vickrey and Mirrlees James Mirrlees and William Vickrey have won the 1996 Nobel prize in economics for helping to answer an important question: how do you deal with someone who knows more than you do? By appearing to trumpet selfishness as the path to prosperity, economists have done much to earn their reputation as dismal scientists. The award of this year's Nobel economics prize, however, should redress the moral balance a little: its two co-winners have been honoured for demonstrating the importance of getting people to tell the truth. Specifically, the two economists - James Mirrlees, who recently moved to Cambridge University after a quarter-century at Oxford, and William Vickrey, who has spent most of his career at Columbia University - have made pathbreaking discoveries in the economics of asymmetric information: the study of transactions in which some of the parties involved know more than the others. Anyone who has bought a used car will know how much this matters. In fact, transactions involving asymmetric (or private) information are everywhere. A manager cannot tell how hard employees are working; a government selling oil-drilling rights does not know what buyers are prepared to pay for them; a lender does not know how likely the borrower is to repay. Private information can distort people's incentives and make it harder for them to pursue their objectives efficiently. (Try selling a used car when nobody trusts you.) The problem facing economists, therefore, is to understand how people can minimise these distorting effects. Although Messrs Mirrlees and Vickrey have worked independently (indeed, they have never met), some of their most important research focused on a similar problem: designing an optimal income-tax system. The ideal system must balance two competing objectives: equity and efficiency. In a paper published in 1945, Mr Vickrey showed that governments must take into account private information in order to strike the right trade-off. To see why, imagine a taxman who cared only about equity, and ignored incentives. He would take money from the rich, and give some back to the poor, until he had raised the revenue he wanted and equalised people's after-tax income. However, since more productive workers can earn more for a given amount of effort, extra effort on their part would be taxed at a higher rate than other people's. Under a pure-equity tax scheme, therefore, the most productive people will not work hard enough. If the government knew how productive each worker was, it would be possible to get around this problem: the authorities could simply force more productive people to work harder than others (which would increase efficiency), and then redistribute everyone's income as before. But the government does not know people's productivity, only their income. Because of this, a pure-equity tax scheme will not work: everyone will underplay their abilities in order to lower their tax bill. Mr Vickrey showed that designing the optimal tax scheme, while accounting for these incentive effects, was far trickier than had previously been imagined. The Truth HelpsEnter Mr Mirrlees, who in the late 1960s found a solution to Mr Vickrey's problem. His most important insight was that an optimal tax system must be what economists now call "incentive compatible." That is, it must give people an incentive to tell the truth, as it were, about their productivity through their choice of how hard to work. So if the government designs a tax scheme in which it wants more productive people to work harder, it must choose tax rates that induce them to do so. Since governments never do anything optimally, these findings have not yet been fully exploited. Over the past few decades, however, the insights gained from optimal-tax theory have been applied to many other fields. Mr Mirrlees's theory has been put to work in the study of insurance. Just as governments cannot observe people's productivity, insurers cannot observe whether their customers have taken proper precautions. By charging deductibles, and making claimants bear a portion of losses, insurers can align their incentives properly. If the premiums reflect the risks that would occur in the event of precautions being taken, the customer must face big enough losses to induce him to take them. Building on Mr Mirrlees's research, economists have been able to improve greatly their understanding of insurance markets. Similarly, Mr Vickrey made important advances in auction theory, which also involves information asymmetries. The problem that the auctioneer must solve is to induce potential buyers to "tell the truth" when they bid: that is, to say what the item being sold is truly worth to them. Mr Vickrey showed that with sealed bids, an auction that awards the item to the highest bidder, but forces him to pay the second-highest price, induces him to do so no matter what strategy he thinks other bidders will follow. Such a "Vickrey auction" not only awards the prize to the party who can make the most of it, but in most cases it allows the seller to obtain at least as high a price as with any other auction. These ideas have been used to sell everything from oil fields to bands of the broadcasting spectrum. By providing insights into these and other problems, this year's laureates have created the foundations for a thriving field in economics. Economists are not only discovering new ways to cope with asymmetric information, but have also come to see that many accepted business practices have evolved to solve precisely this problem. You may still have to deal with selfish people; but at least you can get them to tell you the truth. Source: The Economist 12 October 1996

Moral Calculations: Game Theory, Logic and Human Frailtyby Laszlo Mero Are people ever rational? Consider this: You auction off a one-dollar bill to the highest bidder, but you set the rules so that the second highest bidder also has to pay the amount of his last bid, even though he gets nothing. Would people ever enter such an auction? Not only do they, but according to Martin Shubik, the game's inventor, the average winning bid (for a dollar, remember) is $3.40. Many winners report that they bid so high only because their opponent "went completely crazy." From Reviews:

Futarchy: Vote Values, But Bet Beliefsby Robin Hanson, August 2000 This short "manifesto" describes a new form of government. In "futarchy," we would vote on values, but bet on beliefs. Elected representatives would formally define and manage an after-the-fact measurement of national welfare, while market speculators would say which policies they expect to raise national welfare. Democracy seems better than autocracy (that is, kings and dictators), but it still has problems. There are today vast differences in wealth among nations, and we can not attribute most of these differences to either natural resources or human abilities. Instead, much of the difference seems to be that the poor nations (many of which are democracies) are those that more often adopted dumb policies, policies which hurt most everyone in the nation. And even rich nations frequently adopt such policies. These policies are not just dumb in retrospect; typically there were people who understood a lot about such policies and who had good reasons to disapprove of them beforehand. It seems hard to imagine such policies being adopted nearly as often if everyone knew what such "experts" knew about their consequences. Thus familiar forms of government seem to frequently fail by ignoring the advice of relevant experts (that is, people who know relevant things). Would some other form of government more consistently listen to relevant experts? Even if we could identify the current experts, we could not just put them in charge. They might then do what is good for them rather than what is good for the rest of us, and soon after they came to power they would no longer be the relevant experts. Similar problems result from giving them an official advisory role. "Futarchy" is an as yet untried form of government intended to address such problems. In futarchy, democracy would continue to say what we want, but betting markets would now say how to get it. That is, elected representatives would formally define and manage an after-the-fact measurement of national welfare, while market speculators would say which policies they expect to raise national welfare. The basic rule of government would be: When a betting market clearly estimates that a proposed policy would increase expected national welfare, that proposal becomes law. Futarchy is intended to be ideologically neutral; it could result in anything from an extreme socialism to an extreme minarchy, depending on what voters say they want, and on what speculators think would get it for them. Futarchy seems promising if we accept the following three assumptions:

GDP is today the most common measure of national wealth. It seems hard for frequent travellers to escape the impression that people in high GDP nations tend to be richer and better off than those in low GDP nations. Economists thus tend to be willing to recommend policies that macroeconomic data suggest are causally related to increasing GDP. It seems that it is not that hard to, after the fact, tell rich satisfied nations from poor miserable ones. GDP may be good enough, and with the full attention of our elected representatives, we should be able to do even better, such as by including happiness, inequality, health, leisure, and environment measures. If we can measure how rich nations are, we can use such measurements to settle bets. This is good because betting markets, and speculative markets more generally, seem to do very well at aggregating information. To have a say in a speculative market, you have to "put your money where your mouth is." Those who know they are not relevant experts shut up, and those who do not know this eventually lose their money, and then shut up. Speculative markets in essence offer to pay anyone who sees a bias in current market prices to come and correct that bias. Speculative market estimates are not perfect. There seems to be a long-shot bias when there are high transaction costs, and perhaps also excess volatility in long term aggregate price movements. But such markets seem to do very well when compared to other institutions. For example, racetrack market odds improve on the predictions of racetrack experts, Florida orange juice commodity futures improve on government weather forecasts, betting markets beat opinion polls at predicting US election results, and betting markets consistently beat Hewlett Packard official forecasts at predicting Hewlett Packard printer sales. In general, it is hard to find information that is not embodied in market prices. A betting market can estimate whether a proposed policy would increase national welfare by comparing two conditional estimates: national welfare conditional on adopting the proposed policy, and national welfare conditional on not adopting the proposed policy. Betting markets can produce conditional estimates several ways, such as via "called-off bets," that is, bets that are called off if a condition is not met. For a more detailed and academic discussion of futarchy, see "Shall We Vote on Values, But Bet on Beliefs?" (a pdf file = or you may prefer a ps file). Source: hanson.gmu.edu

This Would Have My Vote...-------- Original Message -------- It reminds me of a very good idea which was floating a while back to create a terrorism futures market - that is, you could bet on the risk of various assassinations, coups, terrorist attacks, et cetera. The idea died a messy death when it kicked off an uproar from people who didn't really understand it, but it was a great idea, and for many of the same reasons. If what you really really want is to aggregate all possible information (be it on the likelihood of one tax rate or another increasing growth, or one target being more likely to be attacked than another), then a market is excellent. Of course, the terrorists market idea DARPA was floating around (called PAM, Policy Analysis Market) was truly awful in design, and probably wouldn't have

worked - the idea was sound though. (Incidentally, the author of this piece had some peripheral involvement in the original research behind PAM.)

For more articles relating to Money, Politics and Law including globalisation, tax avoidance, consumerism, credit cards, spending, contracts, trust, stocks, fraud, eugenics and more

click the "Up" button below to take you to the Table of Contents for this section. |

Animals

Animals Animation

Animation Art of Playing Cards

Art of Playing Cards Drugs

Drugs Education

Education Environment

Environment Flying

Flying History

History Humour

Humour Immigration

Immigration Info/Tech

Info/Tech Intellectual/Entertaining

Intellectual/Entertaining Lifestyles

Lifestyles Men

Men Money/Politics/Law

Money/Politics/Law New Jersey

New Jersey Odds and Oddities

Odds and Oddities Older & Under

Older & Under Photography

Photography Prisons

Prisons Relationships

Relationships Science

Science Social/Cultural

Social/Cultural Terrorism

Terrorism Wellington

Wellington Working

Working Zero Return Investment

Zero Return Investment