Drowning in Debt

Republicans Likely to Borrow for Social SecurityDemocrats were quick to point out that President Bush's budget creates a 1 trillion dollar deficit. - Craig Kilborn by Richard W Stevenson Washington - The White House and Republicans in Congress are all but certain to embrace large-scale government borrowing to help finance President George W Bush's plan to create personal investment accounts in Social Security, administration officials, members of Congress and independent analysts say. The White House said it had made no decisions about how to pay for establishing the accounts, and among Republicans on Capitol Hill there were divergent opinions about how much borrowing would be prudent while the government was running large budget deficits. Many Democrats say that the costs associated with setting up personal accounts would just make Social Security's financial problems worse and that the United States can scarcely afford to add to its rapidly growing national debt. But proponents of Bush's effort to make investment accounts the centerpiece of an overhaul of the retirement system said there were no realistic alternatives to some increases in borrowing, a requirement that the White House is beginning to acknowledge. "The administration hasn't settled on any particular Social Security reform plan," Joshua Bolten, the director of the White House's Office of Management and Budget, said in an e-mail reply to questions about the affordability of overhauling the retirement system. "The president does support personal accounts, which need not add overall to the cost of the program but could in the short run require additional borrowing to finance the transition," he said. "I believe there's a strong case that this approach not only makes sense as a matter of savings policy, but is also fiscally prudent." A reasonable amount of borrowing now, the proponents said, would avert a much bigger financial obligation decades down the road. They said personal accounts would yield higher returns for individuals than the current system and could be a catalyst for broader changes that would bring the benefits promised by Social Security into line with what the system can afford to pay. They said the necessary amount of borrowing could vary widely, from hundreds of billions to trillions of dollars over a decade, depending on how much money individuals were permitted to contribute to the accounts and whether the changes to Social Security included benefit cuts and tax increases. Bush has vowed to push hard to remake Social Security. Republicans in Congress said the White House had signalled to them that Bush would put the issue at the top of his domestic agenda in the coming year. But the White House has never answered fundamental questions about Bush's plan. In particular, it has not explained how it would deal with the financial dilemma created by its call for personal accounts. The way Social Security works now, the payroll tax on current workers goes to pay benefits to current retirees. If the system is changed to allow current workers to divert a portion of their Social Security payroll taxes into the accounts for their retirement, then that money is no longer available to pay benefits to current retirees. The difference has to be made up somewhere. Some conservative analysts and Republicans in Congress said a portion of the gap could be closed through measures like holding down the growth in overall government spending. But nearly everyone involved in the debate over Social Security agrees that some borrowing will be necessary. The main Republican players in Congress on the issue say they expect to endorse an increase in borrowing to finance the transition to a new system. But they remain split over whether to back plans that would include larger investment accounts and few painful tradeoffs like benefit cuts and tax increases - and therefore require more borrowing - or to limit borrowing and include more steps that would be politically unpopular. "Anybody who thinks borrowing money for the transition to personal accounts is going to solve the problem of the long-term solvency of Social Security doesn't understand the size of the problem," said Senator Charles Grassley, Republican of Iowa, the chairman of the Senate Finance Committee, which has jurisdiction over the retirement system. Grassley said Congress would also have to put on the table benefit reductions and tax increases, in part to hold down the need for borrowing and in part to assure that any changes restore Social Security's long-term financial stability. Under current projections used by Social Security's trustees, the government will have to begin drawing on general tax revenue to pay benefits to retirees in 2018, the first year in which scheduled benefit payments will exceed revenues from the payroll tax dedicated to the retirement system. By 2042, the government will have exhausted the Social Security trust fund - its legal obligation to pay back to the retirement system the temporary surplus in payroll tax revenues it has borrowed over the last several decades to subsidise the rest of the budget - and after that Social Security would be able to pay only about three-quarters of promised benefits. Opponents of Bush's approach said Social Security's financial problems could be dealt with more easily without the addition of personal accounts, and that any large-scale borrowing would erase the presumed economic advantage of establishing the accounts: spurring more national savings, a goal that nearly all economists agree is worthy and important. Any increase in private, individual savings, they said, would be partially or wholly offset by an increase in public debt. The White House, which has promised to cut the deficit in half while making permanent Bush's tax cuts, has signalled that it does not intend to include the figures in its budget since the administration has not endorsed a detailed plan. The budget deficit in the year ended 30 September was $413 billion. The total national debt is about $7.5 trillion. Source: www.iht.com from The New York Times Saturday 27 November 2004

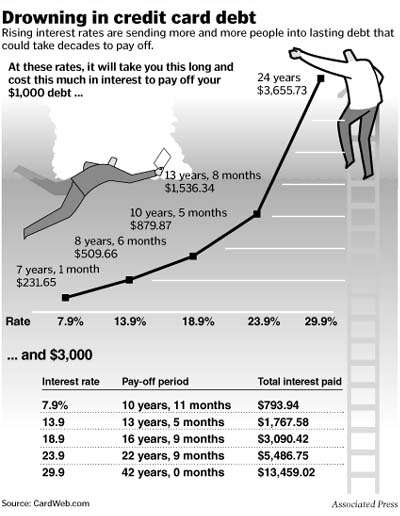

American Seniors Rack up Debt Like Never BeforeMedical Expenses often Feed the CycleLife was a lot simpler when what we honoured was father and mother rather than all major credit cards. - Robert Orben

by Christine Dugas Once known for their thrift, older Americans are piling on debt - filing for bankruptcy in record numbers and jeopardising retirement dreams. Many live on little more than Social Security. A sluggish stock market and painfully low interest rates pinch returns on their CDs, bank accounts and stock investments. Tapped out, many in this new generation of seniors turn to credit cards to finance medical bills, expensive prescription drugs and comfortable lifestyles. Dee Rogers, 64, says she and husband Michael, 57, ran up about $63,000 in credit card bills - "just like a couple of spoiled kids." Now seeking help from a credit-counseling agency, she says, "We'll get by, but we'll both have to work until we're dried-up raisins." That isn't the way most people would like to envision their golden years. But debt problems are only likely to become worse as the population ages, bankruptcy experts say. Unlike their parents, Americans retiring now are comfortable with credit cards and debt. They are more likely to use plastic to make up for declining income from savings and investments. As a result, household debt for those 65 and older is skyrocketing - up 164% on average in 8 years, to $20,302 in 2000, according to SRI Consulting Business Intelligence. That compares with a 92% increase for those younger than 65. One national non-profit credit-counseling agency says more seniors are seeking help with ever-more-burdensome debt loads - about $30,000 on average, nearly double the average client's debt. Most older Americans with debt problems are not spendthrifts, though. Medical emergencies, a major home repair or loans to children or grandchildren often are what push them over the edge. "Older people tend to be used to living within their income until some crisis happens," says Tiff Worley, president of Auriton Solutions, a non-profit debt-counseling agency. Because many seniors own a home and have good credit records, they have a higher capacity for debt than younger people. That means debt problems can quickly mushroom. The Push into BankruptcyAlthough older Americans account for a small proportion of total personal bankruptcy filings, they are the fastest-growing group in bankruptcy. About 82,000 Americans 65 or older filed for bankruptcy in 2001, up 244% from 1991, according to the Consumer Bankruptcy Project, a study done at Harvard. After $10,000 in credit card debt began to overwhelm her, Jennie Giannone, 72, finally filed for bankruptcy in March. The retiree in Peabody, Massachusetts, lives on $900 a month in Social Security and some extra cash she makes taking care of an elderly woman. "I can't take the pressure of the bills," she says. Nearly half of the elderly people who end up in bankruptcy say that they filed because of a medical reason, the Harvard study found. After four surgeries within three years, Duane Allen, 68, and his wife, Linda, had racked up about $15,000 in medical bills. Unable to pay them outright, they charged them. Soon, they were treading water and sought help from a debt-counselling centre. As Duane Allen puts it: "We had health and medical problems and put the bills on our credit cards. Pretty soon, it got the best of us." The Allens not only sought help from credit counsellors, but they sold their home and bought a less-expensive mobile home in Yucaipa, California. "I'm old enough to know better," he says. "Once you get involved with credit cards, they've got you." It doesn't always take a medical emergency to precipitate a debt crisis. Out-of-pocket health care expenses for seniors increased nearly 50% from 1999 to 2001, according to a report by the Commonwealth Fund. The costs are likely to go up as more employers eliminate retiree health benefits, which typically provide supplemental drug coverage. At the same time, many managed care companies are cutting prescription coverage from Medigap policies. That forces many elderly Americans to go without medications or pay for them with a credit card. "Before you know it, they have a large amount of debt," says Sandra Vickery, director of the Bourne Council on Aging in Bourne, Massachusetts. The desire to help family members also can trigger financial problems. Seniors "often need someone to tell them that they can't continue to send their son money every month," Worley says. Even worse, some family members take advantage of elderly grandparents, aunts or uncles. "There are a lot of people who exploit the elderly," says Valerie Egzibher, executive director of Legal Services for the Elderly in Charlotte. "They get power of attorney and clean out the elderly person's bank accounts." For other seniors, loneliness and boredom can cause them to seek solace in gambling, sometimes sending them spiraling into debt. Five years ago, the Council on Compulsive Gambling of New Jersey set up a senior outreach program because it found that about 10% of its callers were people 55 and older who had gambling problems. Ed Looney, the council's executive director, says one 72-year-old woman told him that she had lost $300,000 on card games and slot machines since 1980. "It's a sad state of affairs when someone works all their lives and then what they worked so hard for is gone," he says. Although there is the perception that many older Americans are affluent, 44% of retirees say Social Security was their primary source of income this year, up from 38% in 2000, according to an annual survey by the Employee Benefit Research Institute. Unplanned ExpensesWhen seniors live on a fixed income, it's tough to juggle an unexpected expenditure. Stella Barreras, 70, of Cottonwood, Arizona, says her problems started when she needed to dig a deeper well on her property. The $1,500 bill had to be paid upfront, and that depleted most of her cash reserve. As a result, Barreras and her husband, Fabian, who live on a modest income, had trouble keeping up with other bills. They had to wait until they received their cheques from Social Security before they could make credit card payments. "We would get paid on the 3rd of the month, but if the credit card bill had a different due date, then we were late," she says. Soon, late fees and penalty interest rates caused their credit card balance to balloon to about $27,000. Senior citizens with credit card debt used to be an exception. In 1992, 18.6% of Americans older than 65 had an outstanding balance on a credit card, according to SRI Consulting Business Intelligence. By 2000, that had jumped to 46%. "There has been a sea change in the fiscal conduct of seniors," says Leonard Raymond, executive director of Homeowner Options for Massachusetts Elders (HOME), a non-profit housing assistance group based in Boston. "When we started the program 18 years ago, credit cards were a non-issue. Today, our clients have an average credit card debt of $8,000. But we also see people with $30,000, $40,000, $60,000. One client had $202,000 in credit card debt." Home-equity loans and second mortgages also are on the rise among elderly Americans. "A lot of seniors are house-poor," Sandra Vickery says. Their homes have appreciated in value, in many cases causing property taxes to become a large financial burden. These older homeowners are frequently targeted by creditors who try to sell them a home-equity loan. "Property tax information is public," Leonard Raymond says. "It's easy to look up who's behind on their taxes and offer them a loan." It becomes a problem when a predatory lender persuades them to take out a high-interest loan that exceeds their income. For many senior citizens, their only major asset is their home. It becomes a de facto pension, says John Pottow, a bankruptcy expert and recently appointed law professor at the University of Michigan. That's a problem if they file for bankruptcy. Although pensions are a protected asset, in most states only a small amount of home equity is protected in bankruptcy. So if the value of the equity exceeds the state exemption, then a person who files for Chapter 7 bankruptcy will lose their home. Seniors Don't Know Their RightsOlder Americans often compound their debt problems. Many are too embarrassed or too proud to seek help when financial problems arise. "We know that 15% of all senior homeowners eligible for property tax relief in Massachusetts don't take advantage of it," Raymond says. "It's a matter or pride, privacy, confusion or they just don't know about the program." Seniors are often not savvy about credit and don't know their rights when they are contacted by creditors or bill collectors. They become nervous when bill collectors start badgering them. "We've found that any call from a bill collector will incapacitate them for two hours after the call," Tiff Worley says. Though debt problems among the elderly are rising, bankruptcy is usually a last resort. "Elders do other things to avoid bankruptcy," Sandra Vickery says. They may take out a loan or go to a food pantry in an effort to get by, she says. To help out, Bourne has set aside areas on Cape Cod where senior citizens can go shell fishing to supplement their food budget with oysters and clams. In the end, debt problems take an emotional toll, not just a financial toll, on older Americans who often suffer in silence. "They don't sleep at night," Valerie Egzibher says. "Some cry all the time. They don't tell their families. They say they can't bear to ask for charity." Source: USA Today 25 April 2002 © Gannett Company Incorporated

For more articles relating to Money, Politics and Law including globalisation, tax avoidance, consumerism, credit cards, spending, contracts, trust, stocks, fraud, eugenics and

more click the "Up" button below to take you to the Table of Contents for this section. |

Animals

Animals Animation

Animation Art of Playing Cards

Art of Playing Cards Drugs

Drugs Education

Education Environment

Environment Flying

Flying History

History Humour

Humour Immigration

Immigration Info/Tech

Info/Tech Intellectual/Entertaining

Intellectual/Entertaining Lifestyles

Lifestyles Men

Men Money/Politics/Law

Money/Politics/Law New Jersey

New Jersey Odds and Oddities

Odds and Oddities Older & Under

Older & Under Photography

Photography Prisons

Prisons Relationships

Relationships Science

Science Social/Cultural

Social/Cultural Terrorism

Terrorism Wellington

Wellington Working

Working Zero Return Investment

Zero Return Investment