Costs to the Parent

The True Cost of TextbooksThe best of my education has come from the public library... my tuition fee is a bus fare and once in a while, five cents for an overdue book. - Lesley Conger My son and I recently both took college Spanish. The textbook package cost $150 and was wrapped, so that you could not see what was inside (ISBN numbers, for example). If you broke the wrapper, the bookstore would not take the package back (except as "used"). Whenever possible, we of course bought our books online, used or discounted. We do save money when we can by taking the same classes so that we can share books. In this case, I ordered a second-hand set of the Spanish books the class had used the previous year (at a cost of $15) while my son bought a new set from the bookstore for $150. The difference between the two sets was trifling. The publisher had added or deleted a vocabulary word here or there and changed the order of the exercises occasionally. That was ALL. Not only that, but I found I could've ordered the same set my son had bought at the school bookstore NEW from the publisher for a mere $95 while the bookstore FORCED students to pay $150 for the exact same items. Students were not allowed to know what books they were buying until they had paid for them. Racket? Absolutely! I think this borders on crime. Universities are no different than any other hungry corporation. Don't fool yourself into thinking otherwise.

College Textbook Prices Are Unfair and Unnecessaryby David Zhou When I begin my college classes today, my greatest fear will not be term papers or tough professors. Instead, I will be worrying about how much my textbooks will cost me this time, and whether the total will manage to break the $1,000 mark for the 4th semester in a row. That number is not a typo, and I am not alone. College students across the nation are digging ever deeper into their pockets as price tags continue to climb at a dizzying pace. A recent study by the Government Accountability Office revealed that prices are increasing at twice the rate of inflation, and they have risen more than 186% since 1986. Not surprisingly, those kinds of numbers quickly add up. The same study estimated that books and supplies set the average student back almost $900 a year. For most in-state students at public colleges, that amount would be enough to cover more than 25% of their annual tuition. These astonishing figures would be easier to accept if textbooks simply cost that much to manufacture. However, publishers routinely sell identical copies overseas for only a fraction of the US price. Last year, my friend bought for $60 an "international edition" math book the identical American twin of which sells for over $100 more. Even in England in recent years, the prices for identical books have been half those in the US. Some publishers explain the huge discrepancies by blaming the local markets. Since books in general sell at lower prices overseas, publishers would suffer from weak demand if their textbooks were significantly more expensive. These companies also know that American students will continue to buy the books they need, even if prices skyrocket. As a result, we get the pleasure of paying far more than our foreign counterparts for the same product. Ridiculously, publishers are using college students like me to subsidise the feeble international market. For students from families that can comfortably afford college, these inflated prices are unfair and annoying. But for students from less privileged backgrounds who pinch and work to pay tuition (which, amazingly, has increased faster than textbooks), expensive books can be a major barrier to higher education. Some of the most disadvantaged receive financial aid from their schools to pay for their supplies. However, there are also those students who are neither indigent enough to qualify for enough assistance nor wealthy enough to absorb the soaring cost of books. These are the students who truly pay the price. Ironically, they pay thousands or tens of thousands of dollars in tuition to attend classes, but then cannot afford to buy the required reading materials. One of my friends simply refused to buy any books over $50 and relied on online summaries instead, to save money. Not surprisingly, his learning and his grades suffered as a result. The quality of a college education should not hinge on the cost of textbooks. Unfortunately, little has been done in the way of bringing textbook prices back to earth. College students largely suffer in silence. Congress has yet to take any concrete steps toward change. The publishing industry has done nothing helpful. Instead, publishers are actively working to keep prices in the stratosphere. One tactic is to frequently issue "new" editions of textbooks. Often publishers just shuffle the practice problems and add a few pages. If the professor assigns work out of the new edition, then older versions with their different problem and page numbers become obsolete. Students have to buy a new book instead of a cheap used one, even though the content in the two is essentially the same. Another strategy is selling textbooks as part of a more expensive bundled set that can include anything from a book of practice problems to a computer CD-ROM. One of my political science books came with a CD-ROM of chapter outlines. I never used the disc, and I would not have bought it if I had been given a choice. Publishers have defended these price-bloating add-ons as helpful and educational. Maybe. However, even if that is the case, students should be allowed to decide whether they want to spend more money to buy the extras. Fast food chains promote meals bundling burger and fries, but they also sell the burger on its own. The same principle should be applied to textbook supplements. Publishers clearly possess the power to bring prices down. They could stop churning out new editions and toss out the gimmicks - or make them optional - but apparently they'd rather gouge students, which effectively decreases the accessibility of higher education. So until there is enough outcry to force publishers to listen, I'll continue to dread my trips to the bookstore. David Zhou is a junior at Harvard University. Source: news.yahoo.com 19 September 2005 © The Christian Science Monitor

Cost of Raising a ChildIt is difficult to understand precisely what the state hopes to achieve by promoting the creation and perpetuation of a subclass - William J Brennan Jr An upper-income family (husband-wife family earning more than US$64,000 a year before taxes) who had a child in 2000 can expect to spend $241,770 over 17 years for food, shelter and other necessities to raise the child, a federal study shows. Costs, not adjusted for inflation are as follows:

"Other" includes entertainment, reading materials and personal care items. Figures supplied by the Department of Agriculture's Expenditures on Children by Families Source: USA Today 9 July 2001

What surprises me is the fact that the figure for housing is so large and the figure for "other" is so small, considering the fact that "other" would encompass birthday gifts, videos, DVDs, tapes and CDs, movie tickets, computers, software and connect time, sports, pets, books, educational materials, bicycles, scooters, et cetera for a period of almost two decades. It's obvious the authors of this study have found cheaper places that I have to shop, despite the fact that they apparently live in a much nicer neighbourhood (if additional space for one person costs an extra US$90,000 or near enough). Perhaps keeping their kids in a nearby motel would have been cheaper?

Energy Bills Fuel College Tuition HikesI learned law so well, the day I graduated I sued the college, won the case, and got my tuition back. - Fred Allen by Kelly Heyboer Rising professors' salaries, new campus construction projects and unexpectedly high fuel costs mean students at New Jersey's four-year colleges will see a rise in their tuition costs. Students can expect to pay between 2.9% and 10% more when their first tuition bills arrive later this summer, according to a Star-Ledger survey of the state's colleges. Though tuition has been rising steadily for years, this year's increases are higher than usual at half of the state's universities. At the private colleges, undergraduates will pay from US$11,300 at Bloomfield College to US$26,160 at Princeton University annually, before the cost of room, board, books or student fees are added. At the public colleges, New Jersey undergraduates will pay between US$3,705 at Richard Stockton College in Pomona and US$5,250 at Rutgers University. (New Jersey Institute of Technology in Newark, which charged US$5,758 last year, will decide its tuition on July 26.) Nationwide, tuition at four-year colleges has been rising at two to three times the rate of inflation since 1980, according to the College Board. New Jersey officials say this year's increases are due to the usual increases in faculty salaries, upgrading computers and the other costs that come with running a college campus. But this year, students are also being asked to chip in for other costs, including unexpectedly high fuel bills. Add another US$7,500 or so for room and board and the total varies between US$11,205 and US$33,660 per year. Source: The Sunday Star-Ledger 15 July 2001

The figures given above are in US dollars. I would like to compare these figures to the cost of tertiary education in New Zealand. At the University of Canterbury, where my son studied computer science, tuition was NZ$3,410 to $4,210 depending of the course of study (for international students, this rose to NZ$13,500 - 20,500 per year, indicating just how much of the cost is defrayed for New Zealanders). Room and board runs NZ$6,200 - 6,850. This means the total varies between NZ$9,810 - and $11,060. Convert this to US dollars and we have tuition, room and board costing US$4,120 - 4,650. Even if you add four return (round-trip) tickets back to the US at a generous US$1,750 each, so the student can go home at the end of each term for a visit with mom and dad, a US student could go to university in New Zealand for a mere US$15,000 - $18,500 per year. Not much of a savings, you think? Consider that the student could earn a bachelor's degree in New Zealand in three years rather than the four required in the US, which would save even MORE money. Plus, students would have the experience of living in a different culture, attending smaller classes, and they'd even learn to love rugby! Why aren't US students clamouring to get in to NZ universities? And why don't NZ students appreciate their situation a little bit more than they do???

I do have one thing to add regarding reducing the cost of getting an education in the US - a way I discovered quite by accident. If you decide on a private 4-year school you wish to attend, find out if they have articulation agreements with any community colleges in the area. It is possible to attend the community college for two years at a steeply reduced rate, then transfer all the hours to the 4-year college. Not only that, but if you managed to make the Dean's List and get into Phi Theta Kappa at the community college, you may be eligible for a merit scholarship that can significantly reduce your expenses for your last two years (assuming you maintain a high GPA - but that seems to be fairly easy to do, at least at some community colleges).

By the NumbersSome back-to-school numbers to ruin your morning: $5,033 Average spent to get a student back to school. The average spent in some categories: electronics, $532 $22,757 What it would cost if a shopper put that $5,033 in purchases on a credit card with a typical interest rate of 17.99% and paid only the minimum each month? It would take 54 years to pay off the debt. $16,000 Average debt today for a student leaving a private college. 60 Percentage of American adults who will make at least one back-to-school purchase this year, either for themselves, their child or children, or another student in their life. Data Sources: Myvesta.org, a national, nonprofit organisation devoted to financial counseling, and Capital One Financial Corporation Source: Newspaper article of unknown origin (I found it stuck in a book at the library)

Interest Determined by T-bill Formulaby Sandra Block Parents and students who borrow to pay for college could get a big break this summer, when interest rates are expected to fall to about 4% for most student loans. Interest rates on federal Stafford loans are recalculated annually on 1 JuIy, based on a formula tied to interest rates for short-term Treasury bills. Unless those rates shoot up during the next few weeks, rates for student loans will fall to record lows, student loan experts say.

Who stands to gain:

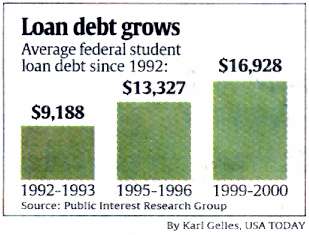

If rates remain unchanged, the accrual rate could fall to as low as 3.5%, said Patricia Scherschel, marketing executive for Sallie Mae, which funds student loans. That means students will have smaller balance when they start repaying their loans. A significant increase in short-term interest rates by the 28 May Treasury auction appears unlikely. In testimony before Congress last week, Federal Reserve Board Chairman Alan Greenspan indicated he is in no hurry to raise interest rates because the economic rebound could still falter. The Fed typically raises interest rates to ward off inflation, which appears under control. The expected decline in interest rates comes at a time when students are leaving college with record levels of debt. The average debt among student borrowers has nearly doubled in the past decade to $16,928, according to recent analysis by the Public Interest Research Group. Source: USA Today Thursday 25 April 2002

A College Education for Just PenniesIt is no big secret that a college education has become a very expensive investment. Parents and students all face the reality that they will be paying off those darn student loans for many years to come. But wait! There IS a better way... Just use your brain power. Focus on the problem (lack of money) and a possible solution (sorry, the chance of being adopted by Bill Gates is not a viable option). A guy named Mike Hayes focused on his lack of capital problem and came up with an incredible scheme to solve it. Let's zoom back to 1987. Here we find Mike as a freshman chemistry major at the University of Illinois. Like many others, he is pondering over paying for his education - one that he figures will cost him $28,000 over four years. Then the brainstorm hit him. Mike wrote to columnist Bob Greene at the Chicago Tribune and asked for his help. The help was simple - Bob would ask each of his millions of readers to send just one penny to help finance Mike's college education. I know, it sounds ridiculous. But then, what is a penny? Look around you and I bet there is a penny being ignored. Is it in the cushions of your sofa? Under the bed? In your coat pocket? Most people won't even expend the energy to bend over and pick up a penny sitting on the sidewalk. Well, Bob Greene decided to play along with Mike's crazy scheme and published the column on 6 September 1987. Of course, asking for a penny is fine, but getting people to actually send one is another story. After all, we are a society of couch potatoes. I'm sure that many just read the column and gave a chuckle. And, there was another catch. You can't send a penny through the mail for free. Back then it cost 22¢ to mail a first class envelope. In other words, your penny donation was really going to cost you about a quarter. Surely a scheme like this could never work. Mike was asking for a tremendous amount of pennies. Think about it - $28,000 translates into 2.8 million pennies. That's a big wad of pocket change to ask for. Once the newspaper article appeared, the mail came pouring in. They were all addressed to "Many Pennies for Mike" at his home in Rochelle, Illinois. Some letters were the typical letters of complaint. These people complained that Mike had no right to ask for this money - he was a typical middle-class white male. Surely, many others should get the money before Mike. But then, no one forced anyone to mail Mike their donations. After one month of collecting, Bob Greene followed up on his article. At that point, the Many Pennies for Mike fund had received about 70,000 donations. The donations ranged from the one penny asked for to several checks for $100. The average of all donations was estimated to be 34¢ per envelope. In other words, Mike raked in approximately $23,000! He was only $5,000 short of his goal. 95% of the envelopes had a letter enclosed. One person wrote "I'm 76 years old. Here's a penny. If you use it to buy drugs I hope a bolt of lightning strikes you dead." Another letter from Debra Sue Maffett (Miss America 1983) was signed "love" and included a check for 25 smackeroos. In the end, Mike did get his $28,000 and a bachelor's degree in food science. No one really knows how much more money came in, but Mike agreed to set up an educational scholarship fund with the excess. One can't help but wonder what the IRS thought about this scheme. They probably changed all of their regulations to make sure that the government will get all the money in the future. Source: members.tripod.com/earthdude1

Why didn't Mike major in economics? Or go into politics? The next person to finance his education online sold pixels. Après moi, le deluge...

Something Else That Helps Increase the Cost of an Education:

|

Animals

Animals Animation

Animation Art of Playing Cards

Art of Playing Cards Drugs

Drugs Education

Education Environment

Environment Flying

Flying History

History Humour

Humour Immigration

Immigration Info/Tech

Info/Tech Intellectual/Entertaining

Intellectual/Entertaining Lifestyles

Lifestyles Men

Men Money/Politics/Law

Money/Politics/Law New Jersey

New Jersey Odds and Oddities

Odds and Oddities Older & Under

Older & Under Photography

Photography Prisons

Prisons Relationships

Relationships Science

Science Social/Cultural

Social/Cultural Terrorism

Terrorism Wellington

Wellington Working

Working Zero Return Investment

Zero Return Investment