Disgraceful Conduct

High Road to DisgraceMoney is the most important thing in the world. - George Bernard Shaw by Irene Chapple

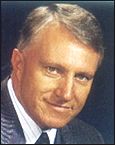

In the 1980s Dr Donald Simcock was one of New Zealand's top tax lawyers. This year he was found guilty of fraud and next week he may be sent to jail. The Harvard graduate's path to disgrace began in 1992, when he became a director of the company managing Flat Rock Forests Trust. The trust, which as its name implies invested in forests, collapsed in 1998, vaporising between $10 million and $14 million of investors' dollars. But, before the investments began to fall apart, Simcock had set up financial structures that channelled money into his hands. Last month, five years after the Serious Fraud Office began investigating the trust, Simcock was found guilty of fraud. On Tuesday the 60-year-old, long recognised as one of New Zealand's pre-eminent tax experts, will be sentenced. He is facing a possible jail term. The offences took place in 1993. In December of that year, Simcock arranged to sell his shares in a company to the trust. He told the trust a $230,000 deposit was required when it wasn't. Simcock was given the $230,000 and used it for the private purchase of shares in Phoenix Communications, which was involved in the syndication of a television cooking show. That was Simcock's third scam of the year. His first two came through the existence of a company called South Pacific Commodity Traders. In January, Simcock introduced South Pacific as a go-between during the purchase of another forest for the trust. South Pacific's existence enabled the price to be inflated and, after it wound its way through another company, extra profit ended up in Simcock's pocket. In April, Simcock used South Pacific again. It was inserted as an intermediary during a trust purchase and again it inflated the price. The two transactions resulted in $150,000 being paid to Simcock which was not his. These dealings all had one thing in common - they were detrimental to the trust, and ultimately to the investors. Simcock's lawyers contend there was no financial benefit to Simcock, just lack of disclosure to the trust. Simcock's explanations to Judge Nicola Mathers, who presided over his 12-day trial - that the $230,000 was a loan; deposits are sometimes made when not stipulated by contract; he was ill and therefore mistaken - did not convince her. They came after the central plank to Simcock's defence, one of legal technicalities, was dismissed. Simcock's lawyer, John Billington, QC, argued that being an officer of the trust's managing company, rather than being the actual manager, lessened the fiduciary duty to the trust. Mathers was unmoved. She found that Simcock, "despite his various statements that he was a mere tax adviser and did not have significant control ... was the driving force and the person who made the decisions..." She found him guilty of three out of five charges. It is believed to be the first conviction of a unit trust manager. Simcock was found not guilty on two charges which related to setting up financial structures through which he would benefit. Mathers said in her judgment she was "not free from suspicion" on those two charges, but not satisfied beyond reasonable doubt that there was the necessary criminal intent. "It can be said in relation to counts 4 and 5," the judgment said, "that it was a close-run thing." The professional demise of Simcock has astounded many of his former colleagues and friends. From all accounts he was pleasant, unassuming, conservative, even a little boring. Some colleagues were probably unaware he was even in court because the trial, held in Auckland, was veiled by suppression orders. With the order intact through the trial, Simcock may have hoped to slide beneath the attentions of the media and his colleagues. He has spent years at the top, lauded as one of New Zealand's best legal talents. During the trial he admitted having been in financial difficulties when he sold shares to the Flat Rock Forest Trust. Simcock has previously said he, too, lost money when the trust collapsed, but his offences came well before the investments crumbled. So why did he do it? Says one former colleague: "It's an enigma." Donald Simcock was a wartime baby to a farming family in Hamilton, the older of two boys who would make their parents proud. He went to law school in Auckland and eventually entered the highest echelons of the legal profession. His younger brother Bob became a clinical psychologist and then a National Party politician, MP for Hamilton West during Jenny Shipley's Government. A lawyer who was in Donald's class at law school remembers he "wasn't in the top of the class, not obviously so", and another says his reputation was for being "fairly thick". Despite that, Simcock became something of a tax star. He would grow to be a quiet man, said to be more interested in going home to his wife and children in Khandallah on a Friday than staying after work for a beer. He has a stocky build, kept trim through a fondness for tennis, which he would play at Wellington's Renouf Centre. His ability in tennis, which he played with three sporting buddies, is recalled as quite good but Simcock's true talent, one in which he excelled, was tax law. At the Inland Revenue Department, where he began work after being admitted to the bar in 1968, he was picked as a leader and sent to Harvard, where he gained a doctorate in tax law. Simcock is believed to be the only New Zealand lawyer able to tack the prestigious SJD (Harvard) after his name. It stands for a Doctorate of Judicial Science, the American school's most advanced law degree. Then there was a 10-year partnership at Bell Gully, beginning when he was snaffled from the IRD around 1980. Simcock set up Bell Gully's tax department and advised clients including banks, accounting firms, large companies and the film industry during its years of favourable tax treatment. He also sat as chair of the tax committees of the New Zealand Law Society and the New Zealand Chamber of Commerce. Simcock's business dealings took him into top boardrooms around New Zealand. But now he has been found guilty of crimes involving what would be regarded as an insignificant sum of money in the business circles he moved in. It is less than half the value of the house in which he lives - the property is in the name of Shirley Simcock, his wife of 34 years - but it is likely to ruin his professional life. Lawyers protect their own and most are abruptly uninterested in inquiries about a former colleague whose reputation has been shattered. Simcock himself is polite, declining an interview on the grounds of legal advice. He says he will be able to talk after the sentencing. Some do answer the Weekend Herald's queries. One recalls Simcock as "a lovely guy". Another says he was "very, very good to me". Another: "I don't believe what the trial has found. This is not the Don I know." So what about Simcock's criminal convictions? "I was shocked," says one, while another says he is "staggered" that such a "talented person could apparently fall from grace like this ... it is fair to say some of the more prominent people he worked for in that period are dumbfounded." But one former colleague remembers Simcock leaving bad blood on his departure from the IRD. "He went away, got his PhD, came back and was made head of the legal section. I think it was four months to the day from getting back to New Zealand that he went off to Bell Gully. So they were all really pissed off about that." Every time the IRD legal department faced Simcock on the opposite side of a case "it would turn the knife in the wound". He set up as an investment consultant in the early nineties. He co-founded and became executive chairman of the New Zealand Enterprise Board, which promoted the forestry investments of the Flat Rock Forests Trust to immigrant hopefuls. The New Zealand Enterprise Board (NZEB), according to the Flat Rock Forests Trust prospectus, "evolved from the activities of the Wellington Regional Enterprise Board which was founded in 1987 by central Government, local Government in the Wellington region and the private sector through the chamber of commerce". The board also had links with the successive Ministers of Immigration, whom it advised on immigration policy. As well as being the promoter of Flat Rock Forests Trust's deals, Simcock was a director of NZEB subsidiary New Zealand Trade and Investment, which managed the trust. The board's brief was to marry high-net-worth individuals with investment opportunities that would assist their immigration applications under Government policies of the time. The trust, which was established in 1992, ran full tilt into the Asian economic crisis and disintegrated after six years when it ran out of money to pay its debts. Critics at the time pointed to, among other things, the trust's failure to follow its prospectus guidelines, which were to buy mature forests, harvest them and pay dividends. In the face of the collapsing log market, the trust borrowed, bought immature forests and was then unable to service its borrowings. The trust's assets were sold for $7.4 million to British buyers. That was enough to pay secured creditor Countrywide Bank and the receivers' costs of $600,000, but not other creditors or investors. Unitholders lost millions, although it is unclear exactly how much, and in 1998 the Serious Fraud Office began investigations. The investors were furious and one, American Ruth Hatch, who lost $500,000, has since set up a detailed website on the trust's manoeuvres. Publicity at the time included an article quoting aggrieved investors saying they were considering a class action suit against its managers. Hatch applied through the courts for a report into the trust's failings, but it found the trust was largely a victim of the collapse of the international forestry market. However, it did say it was "not entirely confident" the trust's management reacted wisely to the deteriorating state of the log market. But while that report exonerated Simcock from blame, the Serious Fraud Office's investigation continued. After five years, that investigation reaches its conclusion with the sentencing of Dr Donald Simcock. Source: nzherald.co.nz 9 August 2003

For news articles on the Flat Rock Forests Trust, forestry, the Serious Fraud Office, one immigrant family's experiences, immigration

specialists, fraud, juries, logging, and more, pressing the "Up" key below will take you to the Table of Contents for this News

section. Or you may wish to visit the Forestry Trust Table of Contents to read how a unit

trust went bust. Or the Topics Table of Contents which offers a different

approach to lots of topics - among them poisonous insects, eating dogs, what's addictive, training vs teaching, tornados, unusual flying

machines, humour, wearable computers, IQ tests, health, Y chromosomes, share options, New Jersey's positive side, oddities, ageing,

burial alternatives, capital punishment, affairs, poverty, McCarthyism, the most beautiful city in the world, neverending work and

lots more... |

Animals

Animals Animation

Animation Art of Playing Cards

Art of Playing Cards Drugs

Drugs Education

Education Environment

Environment Flying

Flying History

History Humour

Humour Immigration

Immigration Info/Tech

Info/Tech Intellectual/Entertaining

Intellectual/Entertaining Lifestyles

Lifestyles Men

Men Money/Politics/Law

Money/Politics/Law New Jersey

New Jersey Odds and Oddities

Odds and Oddities Older & Under

Older & Under Photography

Photography Prisons

Prisons Relationships

Relationships Science

Science Social/Cultural

Social/Cultural Terrorism

Terrorism Wellington

Wellington Working

Working Zero Return Investment

Zero Return Investment